In an era where data is often called “the new oil,” the facilities that house, process, and protect this valuable resource are becoming increasingly critical to our digital economy. Data centers, once viewed as mere cost centers for enterprises, have evolved into a thriving asset class that’s catching the attention of forward-looking investors worldwide. The convergence of artificial intelligence, cloud computing, and digital transformation has created an unprecedented demand for data center infrastructure, presenting a compelling investment opportunity across multiple sectors.

The Data Center Investment Strategy will be a main focus for our investment portfolios for the foreseeable future. The portfolios will obviously remain diversified, but within sectors that touch the data center construction, infrastructure, operation, maintenance, and use, you will see some of the companies mentioned below appear in our portfolios. This is because of their macro investment significance and opportunity for outsized returns, given the growth tailwind behind them.

The Numbers Tell a Compelling Story

The global data center market is experiencing explosive growth, with projections showing an expansion from $187.35 billion in 2020 to a staggering $517.17 billion by 2030. This remarkable 10.5% compound annual growth rate isn’t just a temporary trend – it’s backed by fundamental shifts in how businesses and consumers use technology.

Every digital interaction drives this growth: streaming services, online purchases, cloud-based applications, and emerging technologies. The tsunami of data generated by artificial intelligence, 5G networks, and the Internet of Things (IoT) further accelerates this expansion. When examining these numbers, investors must consider not just the headline growth figures but the underlying drivers that make this growth sustainable.

Investment implications in this sector are particularly compelling due to the recurring revenue models and high barriers to entry. The capital-intensive nature of data centers creates natural moats, while long-term contracts with enterprise customers provide steady cash flows. Early investors in this space have seen substantial returns, but the market’s projected growth suggests significant opportunities remain.

The Players: A Market of Giants

The data center market has consolidated around several dominant players who have established significant barriers to entry. Three companies – Equinix, Digital Realty, and NTT – control roughly 30% of the worldwide colocation market, creating an oligopolistic structure that benefits from economies of scale and network effects.

Equinix has emerged as the global leader in retail colocation, operating over 240 data centers across 27 countries. Their interconnection-focused strategy creates powerful network effects, as each new customer adds value to their ecosystem. The company’s platform offers unparalleled connectivity options, making it the preferred choice for enterprises requiring robust network connections and cloud access points.

Digital Realty dominates the wholesale data center space, leveraging its massive scale and prime locations to serve hyperscale customers. Their strategy of developing mega-campuses in key markets has proven particularly successful, allowing them to meet the growing demand for large-scale deployments while maintaining operational efficiency. The company’s strong balance sheet and development expertise provide significant competitive advantages in an increasingly capital-intensive industry.

NTT’s data center division benefits from its telecommunications heritage, offering integrated solutions that combine connectivity with colocation services. Their strong presence in Asia-Pacific markets positions them well for the region’s rapid digital transformation. The company’s technical expertise and global reach make them a formidable competitor in the carrier-neutral data center space.

These market leaders typically operate as Real Estate Investment Trusts (REITs), offering investors a unique combination of real estate stability and tech sector growth. The REIT structure requires distribution of at least 90% of taxable income to shareholders, providing attractive yields while maintaining growth potential through development and acquisition activities.

Investment Implications

The concentrated nature of the market creates both opportunities and risks. While established players benefit from strong competitive positions and stable cash flows, they must continuously invest in facility upgrades and new developments to maintain their market position. Investors should monitor these companies’ ability to:

- Maintain pricing power in competitive markets

- Fund expansion while managing leverage

- Adapt to evolving customer requirements

- Navigate regulatory changes

- Execute on sustainability initiatives

The Builders Behind the Boom: Data Center Construction Companies

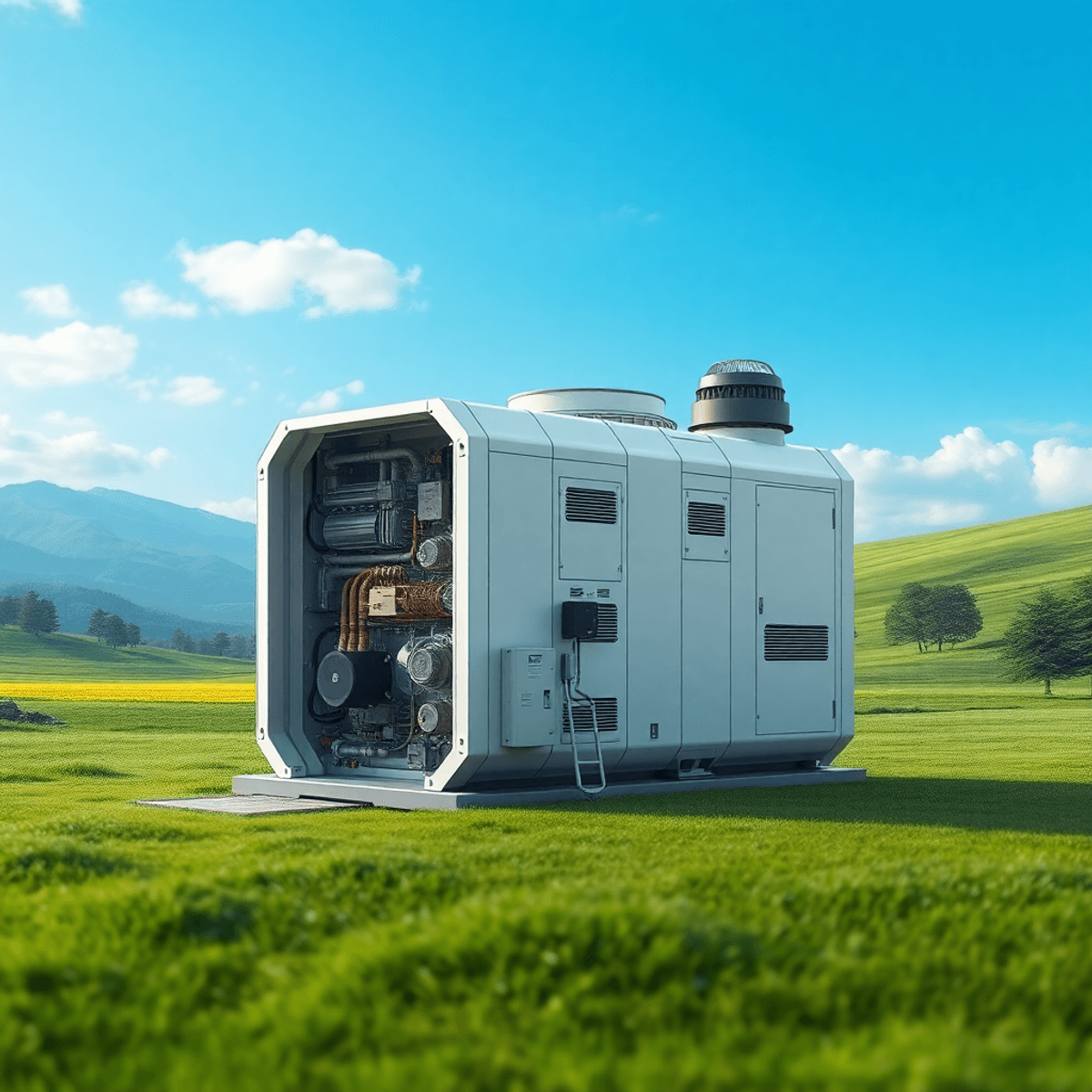

While much of the focus in the data center gold rush is placed on operators, chipmakers, and energy providers, a critical—and often overlooked—piece of the puzzle lies in the construction companies actually building these complex facilities. The development of high-performance, AI-optimized data centers is no longer just about pouring concrete and running power lines. It’s about integrating sophisticated cooling systems, dense power distribution, fiber connectivity, and advanced security from the ground up.

This new era of digital infrastructure has created significant opportunities for select construction and engineering firms that can deliver large-scale, technically advanced projects on aggressive timelines and budgets.

Here are some of the key players building the physical backbone of the digital age:

Jacobs has quietly become one of the most important engineering and construction partners in the data center space. With expertise in mission-critical infrastructure, Jacobs specializes in end-to-end design-build services, including site selection, electrical and mechanical engineering, and complex systems integration. The firm is heavily involved in hyperscale and colocation projects across North America and Europe, where speed, reliability, and resilience are paramount.

Jacobs’ strength lies in their ability to integrate multiple disciplines—from power and water systems to environmental and regulatory compliance—making them a go-to partner for operators building next-generation AI and cloud facilities.

Fluor is a global EPC (engineering, procurement, construction) firm with growing involvement in digital infrastructure projects. The company’s industrial-scale project management capabilities are well-suited to mega-campus builds for hyperscalers like Amazon, Google, and Microsoft. Fluor’s value proposition includes its global supply chain expertise, modular construction capabilities, and experience navigating the logistical and regulatory complexity that comes with multi-billion-dollar developments.

As data center campuses grow in size and scope, Fluor’s ability to handle multi-phase, large-footprint projects gives it a strong edge in this rapidly scaling market.

EMCOR is a lesser-known but deeply embedded player in the data center construction ecosystem, focusing on mechanical and electrical construction services. The company is often brought in to install the specialized electrical infrastructure, HVAC systems, and precision cooling technologies that these high-density facilities demand. EMCOR has developed a niche in fast-track data center projects where operational uptime, redundancy, and thermal efficiency are non-negotiable.

Their repeat relationships with top-tier data center REITs and hyperscale operators reflect EMCOR’s trusted reputation in the mission-critical construction space.

Quanta is best known for its work in power and grid infrastructure, but its role in supporting data center development is increasingly vital. As demand for on-site power generation and dedicated substation builds grows, Quanta’s ability to deliver high-voltage electrical infrastructure directly to data center campuses is becoming a key differentiator.

In regions like Texas and the Midwest, where grid independence and microgrid capabilities are gaining traction, Quanta is emerging as a strategic enabler of energy-integrated data center design.

KBR brings high-level engineering and systems integration experience from its background in defense, aerospace, and industrial technologies. While not traditionally associated with commercial real estate, the company has increasingly moved into specialized facility development, including secure government and private sector data centers.

Its work on high-security, high-resilience facilities makes KBR an ideal partner for financial institutions, government clients, and emerging quantum computing data center builds that require extreme levels of environmental and digital security.

Investment Implications

As the race to build AI-optimized data centers intensifies, construction firms with deep expertise in complex, high-density, and high-security infrastructure are poised to see sustained demand. These companies don’t just build structures—they engineer the environments that will power the future of computing.

Investors should pay attention to construction and engineering firms that:

- Have repeat business with hyperscale or REIT customers

- Offer integrated services across electrical, mechanical, and network systems

- Are positioned to support growth in emerging markets like Texas and the Asia-Pacific

- Have exposure to energy infrastructure, which increasingly overlaps with data center development

As capital floods into digital infrastructure, the companies that can actually build the next wave of AI and cloud facilities will be foundational to the success of the entire ecosystem.

Location, Location, Location: The Texas Advantage

While data centers have traditionally clustered around major metropolitan areas like Northern Virginia’s “Data Center Alley,” a new frontier is emerging in Texas, driven by unique advantages that make it particularly attractive for next-generation data center development. Two companies, Texas Pacific Land Corporation (TPL) and LandBridge (LB), are positioned to capitalize on this opportunity through their strategic land holdings in the Permian Basin.

The Texas Advantage stems from several key factors:

Texas Pacific Land Corp, with its vast land holdings in West Texas, sits atop one of the world’s richest natural gas reserves. This proximity to natural gas fields offers data center operators a compelling proposition: direct access to reliable, relatively clean energy at predictable costs. In an industry where power consumption can represent up to 70% of operating costs, this advantage cannot be overstated.

LandBridge, similarly positioned with significant land holdings in Texas, is developing infrastructure to support data center operations with direct connections to natural gas supplies. This vertical integration model – from energy source to data center operation – represents a new paradigm in the industry.

Recent years have highlighted the importance of power grid reliability for data center operations. Texas’s independent power grid (ERCOT) allows for unique arrangements between power generators and consumers. Data center operators can potentially establish micro-grids powered by natural gas, providing an additional layer of reliability and cost control.

Climate and Space Advantages

While Texas’s heat might seem challenging for data center cooling, the state’s abundant land allows for innovative cooling solutions and facility designs that wouldn’t be possible in more densely populated areas. Modern cooling technologies, combined with the ability to space facilities optimally, can actually turn this perceived challenge into an advantage.

Strategic Position for AI Infrastructure

The combination of abundant energy resources and available land makes Texas particularly attractive for AI-focused data centers, which require significantly more power and cooling capacity than traditional facilities. TPL and LandBridge’s land holdings could become prime locations for these next-generation facilities.

Economic Incentives

Texas’s business-friendly environment, including tax incentives and reduced regulatory burdens, adds another layer of attractiveness for data center operators. The state’s policies actively encourage technology infrastructure development, creating a supportive ecosystem for data center growth.

Infrastructure Ready

Both TPL and LandBridge are developing their lands with data center requirements in mind, including:

– High-capacity power infrastructure

– Water rights and management systems

– Fiber optic connectivity

– Transportation access

– Security infrastructure

Investment Implications

The Texas model, pioneered by companies like TPL and LandBridge, could represent the future of data center development. As AI and quantum computing drive demand for more power-intensive computing facilities, the ability to co-locate data centers with energy sources while maintaining grid independence could become increasingly valuable.

For investors, companies like TPL and LandBridge offer unique exposure to the data center industry’s growth through their land holdings and energy resources rather than through traditional data center operations. This positioning could provide significant upside as the industry continues to evolve and power demands increase with the adoption of AI and quantum computing technologies.

The Infrastructure Challenge: More Than Just Buildings

The complexity of modern data center infrastructure extends far beyond simple warehouse construction, creating a multifaceted investment opportunity across various technical domains. These sophisticated facilities demand careful planning, enormous resources, and continuous innovation to meet evolving technological requirements.

Energy consumption stands as perhaps the most critical infrastructure challenge. Data centers currently consume 3-4% of global electricity, with this figure projected to rise significantly as AI workloads increase. This challenge presents both risks and opportunities for investors. Companies that successfully optimize their power usage and transition to renewable energy sources while maintaining reliability are positioned to capture significant market share.

Cooling systems represent another crucial infrastructure component, accounting for approximately 40% of a data center’s energy consumption. Innovation in this space has become a key differentiator.

Leading operators are developing more efficient cooling technologies, from artificial intelligence-controlled systems to experimental approaches like underwater data centers. Companies like Vertiv (VRT) and Schneider Electric have emerged as leaders in this space, providing critical cooling infrastructure and power management solutions.

The networking infrastructure requirements have also evolved dramatically. Modern data centers require sophisticated fiber optic networks, advanced switching systems, and increasingly complex security infrastructure. Companies like Arista Networks and Cisco Systems dominate this space, providing the critical infrastructure that enables data center connectivity.

Water management has become another crucial infrastructure consideration. Traditional cooling systems can consume millions of gallons of water annually, making water rights and conservation technologies increasingly valuable. Mueller Water Products (MWA) has positioned itself as a key player in this space, providing specialized flow control and monitoring systems.

Investment implications

Investment implications in the infrastructure space are particularly compelling due to:

– High barriers to entry in specialized technical domains

– Strong recurring revenue from maintenance and upgrades

– Growing demand for efficiency improvements

– Increasing focus on environmental sustainability

The winners in this space (as detailed above)will be companies that can provide integrated solutions addressing multiple infrastructure challenges while maintaining flexibility to adapt to evolving requirements, particularly those driven by AI and quantum computing workloads.

Energy: The Critical Backbone of Data Center Operations

The exponential growth in data center power requirements, particularly driven by AI workloads, is forcing the industry to rethink its energy strategy. While renewable sources like solar and wind play important roles, the need for reliable, consistent, and scalable power is pushing data center operators toward a more diverse energy portfolio, with natural gas/LNG and nuclear power emerging as critical components.

Natural Gas and LNG: The Bridge to the Future

Natural gas has emerged as a cornerstone of data center energy strategy, offering a compelling combination of reliability, cost-effectiveness, and environmental performance. The ability to access consistent baseline power, regardless of weather conditions, makes natural gas particularly attractive for data center operators who cannot tolerate service interruptions. Modern combined-cycle plants achieve efficiency rates up to 60%, significantly reducing both costs and emissions compared to traditional fossil fuels.

The economics of natural gas become even more attractive when considering direct access to gas fields. Companies with strategic land positions near natural gas reserves can significantly reduce transportation costs and secure long-term supply contracts at predictable prices. This vertical integration approach, combining land ownership, energy production, and data center operations, represents a new paradigm in the industry.

Furthermore, natural gas infrastructure readily supports the development of micro-grids and on-site power generation, providing data center operators with unprecedented control over their power supply. The flexibility to scale power generation up or down based on demand, combined with the ability to hedge through futures markets, offers a level of operational control that’s difficult to achieve with other energy sources.

The Nuclear Revolution: Small Modular Reactors (SMRs)

Small Modular Reactors represent perhaps the most exciting development in data center power supply. These next-generation nuclear facilities offer continuous, carbon-free power generation in a surprisingly compact footprint. Unlike their larger counterparts, SMRs are specifically designed for industrial applications, making them ideal for data center complexes.

Companies like NuScale Power (NU), and Rolls-Royce SMR (RYCEY) are at the forefront of this revolution, developing reactors that promise to transform the energy landscape. While initial capital costs range from $500 million to $2 billion per unit, the 60-year operational lifespan and minimal fuel costs make SMRs increasingly attractive for long-term energy planning.

Hybrid Energy Solutions: The Path Forward

The future of data center energy lies not in choosing between these options but in combining them effectively. A modern data center complex might utilize SMRs for baseline power, supplemented by natural gas for load following and peak demand periods, with plans to transition to green hydrogen over time. This hybrid approach provides the reliability and scalability needed for AI and quantum computing workloads while maintaining operational flexibility.

Investment Implications

The evolving energy landscape creates multiple investment opportunities across the value chain. Energy infrastructure players, including midstream natural gas companies like Williams Cos (WMB) and LNG terminal operators like VG and Cheniere (LNG), stand to benefit from increased demand for natural gas transportation and storage. Companies developing and deploying SMR technology represent another exciting investment avenue, particularly as the technology matures and deployment accelerates.

Companies holding strategic land positions near natural gas reserves or along key transportation corridors are particularly well-positioned. These assets become increasingly valuable as data center operators seek to optimize their power supply chains and reduce operational costs.

Looking to the Future

The energy requirements for data centers will continue to evolve as AI and quantum computing drive demand for more intensive computing resources. Near-term developments through 2030 will likely focus on increased natural gas adoption and the first commercial SMR deployments. The 2030-2035 period should see significant expansion of SMR fleets and the integration of advanced cooling technologies.

Looking beyond 2035, next-generation nuclear technologies and advanced energy storage solutions will likely reshape the landscape further. The potential integration of hydrogen technology and carbon capture and storage systems could provide additional options for data center operators.

For investors, the key lies in understanding this evolving landscape and positioning accordingly. Direct infrastructure investments in natural gas processing facilities, LNG terminals, and SMR technology companies offer immediate exposure to the sector’s growth. Supporting infrastructure, including pipeline networks and water treatment facilities, provides additional investment opportunities.

The combination of natural gas/LNG and nuclear power, particularly through SMRs, provides data center operators with a reliable, scalable, and relatively clean energy solution. As the industry continues to grow and evolve, those who recognize and act on these trends stand to benefit significantly from the ongoing digital transformation of our economy.

The Utilities

The transformation of power requirements in the data center industry has created unprecedented opportunities for forward-thinking utility companies. Three companies in particular – AES Corporation (AES), Constellation Energy Group (CEG), and Vistra Corp (VST) – have emerged as pivotal players in powering the digital economy.

AES Corporation has positioned itself at the intersection of traditional power generation and renewable energy innovation. Their strategic shift toward providing clean, uninterrupted power to data centers has proven prescient, with direct partnerships with major tech companies including Google and Microsoft. AES’s hybrid approach, combining conventional power sources with renewable energy, provides the reliability data centers demand while meeting increasingly stringent environmental requirements.

Constellation Energy Group, as America’s largest producer of carbon-free energy, brings a unique value proposition to the data center market. Their nuclear fleet, producing over 90% of their total generation, provides the consistent baseline power that data centers require. CEG’s recent investments in small modular reactor technology, coupled with their existing nuclear expertise, position them to capitalize on the growing demand for carbon-free power in the data center industry.

Vistra Corp has transformed itself from a traditional Texas-based utility into a national power provider with a specific focus on data center markets. Their Luminant division’s natural gas fleet provides the flexible generation needed for peak demand periods, while their growing renewable portfolio helps customers meet sustainability goals. VST’s strategic advantage lies in their integrated model, controlling generation, transmission, and retail operations.

These utilities face both opportunities and challenges in serving the data center market. The opportunity lies in the sector’s explosive growth and willingness to sign long-term power purchase agreements. However, they must navigate the complex balance between reliability requirements, environmental considerations, and cost pressures.

The utility sector’s transformation presents several compelling investment themes. Companies successfully pivoting to serve data center customers are likely to see higher growth rates and more stable revenue streams than traditional utilities. Long-term contracts with data center operators provide predictable cash flows, while the need for new infrastructure creates opportunities for rate base growth.

The Advanced Chip Makers

The exponential growth in data center computing requirements has placed unprecedented demands on semiconductor manufacturers. At the heart of this transformation lies a complex ecosystem of chip makers, each playing a crucial role in enabling the AI and quantum computing revolution.

ASML Holdings stands alone as the world’s sole manufacturer of extreme ultraviolet (EUV) lithography machines, the essential tools needed to produce the most advanced semiconductors. This unique position makes ASML a critical enabler of data center evolution. Their machines, costing upwards of $150 million each, represent one of the most sophisticated pieces of technology ever created. The company’s virtual monopoly in EUV technology provides both tremendous opportunity and responsibility in supporting the data center industry’s growth.

Taiwan Semiconductor Manufacturing Company (TSM) has emerged as the world’s premier semiconductor foundry, producing chips for many of the industry’s leading designers. Their advanced manufacturing processes, particularly their 3nm and upcoming 2nm nodes, are essential for meeting

the demanding requirements of AI and data center applications. TSM’s strategic importance extends beyond pure manufacturing capability – their technology leadership has made them a crucial partner for companies like NVIDIA and AMD.

NVIDIA has transformed itself from a gaming graphics company into the dominant force in AI computing. Their GPU technology, originally designed for video games, has become the backbone of AI processing in data centers worldwide. The company’s data center revenue now exceeds its gaming revenue, reflecting this fundamental shift. Their latest H100 and upcoming H200 chips specifically target the growing demands of large language models and AI applications.

AMD has successfully challenged Intel’s traditional dominance in data center processors while also expanding into AI acceleration with their MI300 series chips. Their EPYC processors have gained significant market share in traditional data center applications, while their new AI accelerators position them to compete in the rapidly growing AI infrastructure market.

ARM Holdings, through its chip design architecture, influences a growing portion of data center computing. Their energy-efficient designs are becoming increasingly important as data centers struggle with power consumption challenges. The company’s licensing model allows for widespread adoption while maintaining consistent profitability.

The AI Revolution: A Game-Changer for Data Centers

The rapid adoption of artificial intelligence is fundamentally reshaping the data center landscape in unprecedented ways. AI workloads are transforming traditional infrastructure requirements, with power consumption per rack increasing from traditional levels of 5-10 kW to over 80 kW for AI applications. This dramatic shift is driving a surge in demand for AI-ready data center capacity, with growth projected at 33% annually through 2030.

Investment Implication

The investment implications of this AI revolution extend far beyond simple power requirements. Modern AI-optimized data centers demand:

– Specialized power distribution systems capable of handling high-density computing

– Enhanced cooling capabilities to manage concentrated heat loads

– Advanced networking infrastructure to support massive data transfers

– Flexible architecture to accommodate rapidly evolving AI hardware

Companies like NVIDIA and AMD are driving this transformation through their specialized AI accelerators. NVIDIA’s H100 and upcoming H200 chips have become the de facto standard for AI training, while AMD’s MI300 series is gaining traction in the market. This hardware evolution is forcing data center operators to redesign their facilities from the ground up.

The impact on data center economics is equally profound. While traditional data centers could operate profitably at 5-10 kW per rack, AI-focused facilities must support much higher power densities while maintaining efficiency and reliability. This shift favors operators who can access abundant, reliable power sources and deploy advanced cooling solutions.

Investment implications in this space are particularly compelling. Companies that can successfully adapt their infrastructure to support AI workloads are seeing premium valuations and stronger customer relationships. The market is increasingly differentiating between traditional data centers and those optimized for AI applications, creating opportunities for investors who understand this evolution.

Looking ahead, the AI revolution in data centers is likely to accelerate. As language models and other AI applications grow more sophisticated, their computing requirements will continue to increase. Data center operators who position themselves now for this ongoing transformation stand to benefit significantly from the industry’s evolution.

The Quantum Computing Wild Card

While artificial intelligence is already transforming data centers, quantum computing represents an even more revolutionary frontier. This emerging technology promises to fundamentally reshape how we process and store information, creating both opportunities and challenges for data center operators and investors.

Companies like Rigetti Computing, IBM Quantum, and Google Quantum AI are at the forefront of this transformation. Rigetti’s superconducting quantum processors represent a significant advancement in quantum computing technology, while IBM’s ambitious roadmap targets 4,000+ qubit systems by 2025. These developments demand entirely new approaches to data center design and operation.

The infrastructure requirements for quantum computing are particularly challenging:

– Temperature Control: Quantum computers require extremely low temperatures, often approaching absolute zero, necessitating specialized cooling systems far beyond traditional data center capabilities.

– Power Management: The energy requirements for maintaining quantum states and cooling systems create unique power distribution challenges.

– Space Considerations: While quantum computers themselves may be relatively compact, their supporting infrastructure requires significant space allocation.

– Specialized Connectivity: Quantum systems need ultra-low latency connections and specialized interfaces between quantum and classical computing systems.

Companies like ATKR (Atkore) and Vertiv (VRT) are positioning themselves to meet these infrastructure challenges. Atkore’s electrical raceway solutions and Vertiv’s critical infrastructure systems will play crucial roles in supporting quantum computing’s unique requirements. Mueller Water Products (MWA) has emerged as a key player in developing specialized cooling solutions necessary for quantum systems.

Investment Implications

Investment implications in the quantum computing space span multiple sectors:

– Early-stage quantum hardware and software developers offer high-risk, high-reward potential

– Infrastructure providers supplying specialized cooling and power solutions present lower-risk exposure

– Large technology companies investing in quantum development provide diversified exposure

The Edge Computing Frontier: Powering the Perimeter of the Digital World

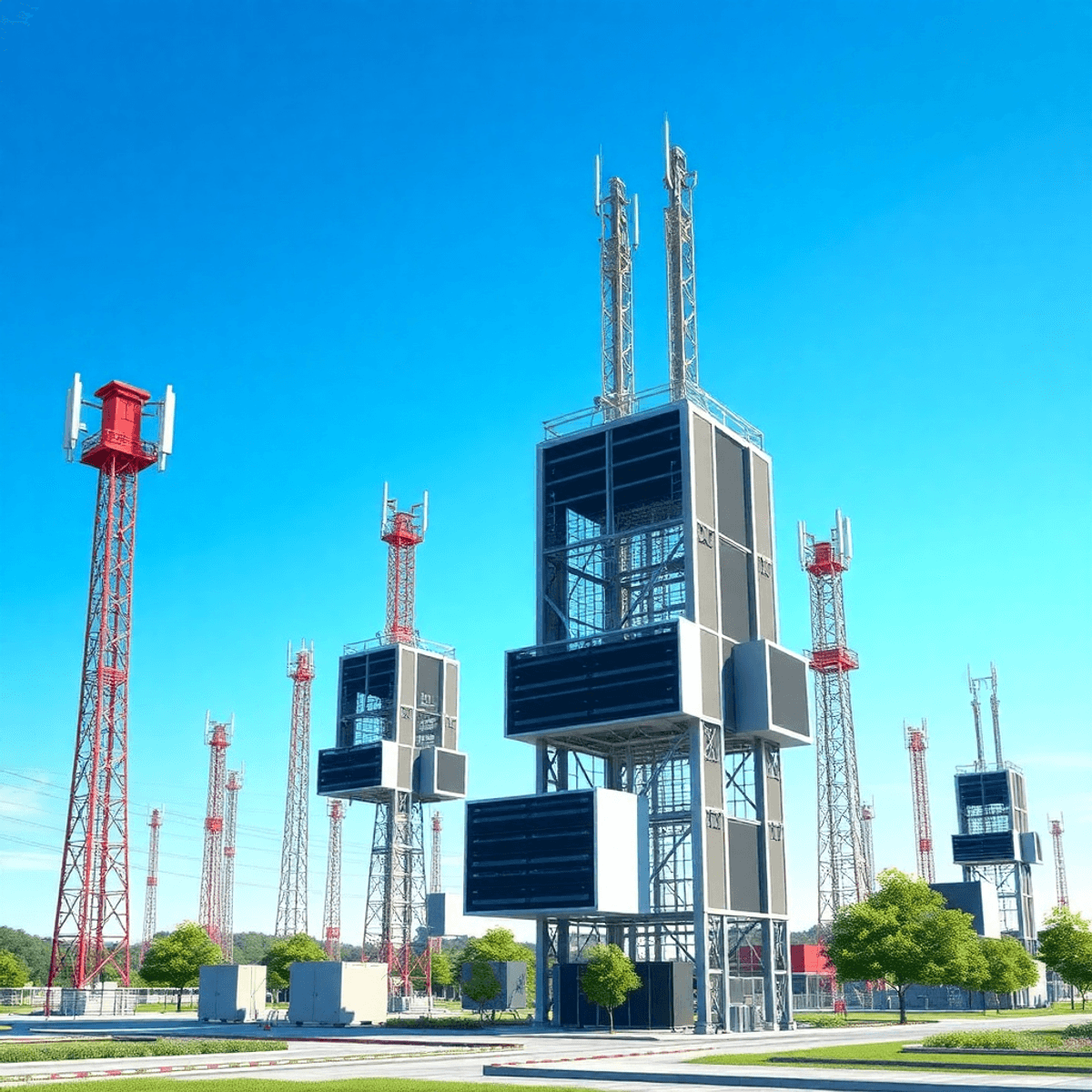

As data creation accelerates and applications demand ever-lower latency, the data center industry is undergoing a profound structural shift. While hyperscale campuses will continue to dominate in raw capacity, edge computing is emerging as the next frontier in digital infrastructure—bringing computing power physically closer to the source of data generation. Whether enabling autonomous vehicles, real-time industrial automation, or immersive AR/VR experiences, edge computing redefines where and how data is processed.

Edge computing refers to the deployment of computing, storage, and networking resources closer to the end user or data source—whether that’s a factory floor, a city intersection, or a cell tower. Unlike traditional centralized data centers, which process data far from the point of creation, edge data centers are designed to handle workloads locally, in real time, with minimal latency. These facilities are typically smaller, more distributed, and optimized for rapid processing and response. The goal isn’t to replace hyperscale data centers but to complement them—handling time-sensitive tasks at the edge while routing less urgent compute jobs back to core facilities. This hybrid model unlocks new capabilities across industries, from autonomous vehicles and industrial automation to smart retail and immersive digital experiences.

Edge data centers are not simply “smaller versions” of their hyperscale counterparts. They are purpose-built to operate in diverse environments—urban rooftops, telecom towers, even remote locations—and must deliver low-latency compute, high-reliability networking, and secure, scalable processing in constrained physical and power footprints.

This shift has profound implications for the data center value chain—and creates a growing opportunity for investors.

Building the Edge: Companies Shaping the Landscape

A new class of companies is emerging to serve this highly distributed architecture. These firms are building networks of micro data centers, enabling localized AI inference, and delivering services at the very edge of networks.

Operating one of the world’s most distributed edge platforms, Cloudflare brings security, performance, and compute functionality to over 300 cities globally. Their Cloudflare Workers serverless platform enables developers to run code directly at the edge, minimizing latency for real-time applications.

Fastly’s edge cloud platform accelerates web and application delivery while enabling edge compute for dynamic content and modern workloads. Known for developer-friendliness and high-speed architecture, Fastly is a key player in media, retail, and API-based services where responsiveness is critical.

A legacy CDN giant turned edge platform provider, Akamai’s EdgeWorkers and Linode acquisition provide a full-stack solution for running applications close to users. Their global network and enterprise reputation make them a trusted edge partner for Fortune 500 companies.

Telecom-Enabled Edge: The Tower Advantage

The physical proximity to mobile users makes telecom infrastructure an ideal host for edge computing. Companies that own or operate cell towers and small cells are repurposing these assets into micro data centers that support 5G, IoT, and real-time applications.

American Tower Corporation (AMT)

Through its Edge Data Center initiative, AMT is deploying micro data centers at tower sites, particularly in second-tier cities where latency reduction is vital. Their real estate footprint and access to power at the base of towers offer unique scalability advantages.

Crown Castle International (CCI)

CCI is integrating fiber, small cells, and edge assets to support mobile operators and enterprise edge applications. Their focus on urban fiber routes and 5G-ready infrastructure positions them to serve the densification needs of mobile edge computing.

Verizon (VZ) and AT&T (T)

Both telecom giants are rolling out Multi-Access Edge Computing (MEC) in partnership with cloud providers like Amazon (AWS Wavelength) and Microsoft (Azure Edge Zones). These services allow enterprise customers to run latency-sensitive workloads directly from telecom facilities.

Edge Hardware and Network Enablers

Edge computing infrastructure demands specialized hardware that’s compact, energy-efficient, and rugged. At the same time, it requires advanced networking to support ultra-fast, secure data transfer.

SMCI delivers modular servers purpose-built for edge deployments—ruggedized, compact, and energy-efficient systems capable of running AI inference or real-time analytics with minimal latency. Their customizable designs are increasingly used in edge AI, telecom, and industrial settings.

Marvell supplies the silicon backbone for edge networks—network interface controllers, storage solutions, and custom SoCs that enable edge compute nodes to operate efficiently and securely.

Arista Networks and Cisco Systems

These firms remain dominant in network switching, security, and infrastructure management—both in core data centers and increasingly at the edge. Their ability to deliver robust, scalable networking is essential for distributed compute environments.

Investment Implications

The edge computing shift is not a replacement for centralized data centers—it is a powerful complement that expands the digital economy’s reach. The combined architecture allows for latency-sensitive tasks to occur at the edge, while heavy compute and storage remain centralized. This hybrid model is creating new opportunities across the value chain.

Investors should watch for:

- Companies deploying or enabling edge infrastructure with dense, localized footprints

- Hardware providers specializing in rugged, low-power, high-performance systems

- Telecom REITs and operators with tower, fiber, or small cell assets near users

- Edge platforms offering serverless or containerized compute close to end devices

As applications like autonomous driving, real-time AI, and industrial IoT mature, edge infrastructure will become just as critical—and investable—as hyperscale campuses. The winners will be those who can scale distributed networks without sacrificing reliability, security, or efficiency.

The Customer Landscape: Following the Money

Understanding who uses data centers is crucial for evaluating investment opportunities. The customer landscape has evolved significantly, creating distinct market segments with different needs and growth trajectories.

Hyperscale cloud providers – Amazon Web Services, Microsoft Azure, and Google Cloud Platform – are driving the majority of industry growth, expected to generate 60% of expansion through 2028. These customers demand increasingly larger facilities, with average data center size projected to grow from 40 MW to 60 MW by 2028. This trend favors operators who can deliver massive scale while maintaining efficiency and reliability.

Enterprise customers are rapidly shifting away from operating their own facilities, creating opportunities in the colocation market. Enterprise on-premises data center power demand is expected to drop from 10% to 5% by 2028, representing a significant migration toward third-party facilities. This transition benefits colocation providers who can offer flexible solutions and robust connectivity options.

The AI boom has created a new category of customers with unique requirements. Companies developing and deploying large language models and other AI applications need specialized facilities capable of handling high-density computing loads.

These customers often require:

– Enhanced power capacity (80+ kW per rack)

– Advanced cooling systems

– Sophisticated networking infrastructure

– Flexible expansion options

Data center operators such as CoreSite (a subsidiary of American Tower, AMT), CyrusOne (private, but relevant in sector context), and Switch Inc. (acquired by DigitalBridge, DBRG) are tailoring offerings to meet these demands. Additionally, NVIDIA (NVDA) and Super Micro Computer (SMCI) represent key suppliers enabling AI compute infrastructure within these facilities.

Financial services firms remain crucial customers, particularly in major markets like New York, London, and Singapore. Their demand for ultra-low latency connections and high-security environments creates opportunities for specialized Edge facilities near financial centers. Equinix, in particular, has a strong presence in these cities, offering interconnection services critical to trading firms and financial institutions.

Investment implications

Investment implications in the customer landscape are significant. Operators who can successfully serve multiple customer segments while maintaining operational efficiency tend to command premium valuations. Those with strong relationships with hyperscale customers benefit from large, stable contracts, while those serving enterprise customers can often achieve higher margins through value-added services.

Investment Considerations: What to Watch For

The data center sector’s rapid evolution demands a sophisticated approach to investment analysis. Several critical factors deserve particular attention when evaluating opportunities in this space:

Location Strategy has become increasingly nuanced. While traditional metrics like power costs and fiber connectivity remain important, new considerations such as natural disaster risk, political stability, and access to renewable energy sources have gained prominence. Markets with favorable combinations of these factors command premium valuations, particularly those positioned to support AI workloads.

Technical Capabilities now extend far beyond basic infrastructure. Successful operators must demonstrate their ability to:

– Support high-density AI computing environments

– Implement advanced cooling solutions

– Maintain robust security protocols

– Adapt to rapidly evolving customer requirements

– Scale efficiently while maintaining reliability

Financial Structure analysis is crucial given the capital-intensive nature of the industry. Companies need strong balance sheets and access to capital markets to fund growth. The REIT structure, while providing tax advantages and consistent distributions, also creates specific financial constraints that investors must understand.

Customer Relationships have become increasingly strategic. The ability to serve hyperscale customers while maintaining a diverse client base is crucial. Long-term contracts with credit-worthy customers provide stable cash flows, but concentration risk must be carefully managed.

Environmental Strategy: From Marketing Message to Market Mandate

What was once viewed as a public relations checkbox has become a core strategic imperative in the data center industry. Environmental stewardship is no longer optional—it is a determinant of customer preference, investor interest, and long-term viability. The most successful operators are embedding sustainability into every layer of their operations, and the companies that lead in this area are being rewarded with premium valuations and stronger customer loyalty.

- Equinix (EQIX) has set an industry benchmark by committing to 100% clean and renewable energy across its global data center footprint. The company has executed multiple long-term power purchase agreements (PPAs) and was one of the first to issue green bonds specifically tied to sustainability-linked infrastructure investments. Their approach to carbon neutrality includes both renewable procurement and investment in energy efficiency initiatives across their more than 240 data centers.

- Digital Realty Trust (DLR) has taken a leading position in water conservation and resource transparency. Through its Data Center Sustainability Toolkit and collaboration with customers, DLR actively monitors and reports water usage effectiveness (WUE) metrics while pursuing closed-loop and air-cooled system designs to minimize water impact, especially in drought-prone areas.

- Vertiv Holdings (VRT) plays a critical role as a technology provider that enables energy efficiency improvements at the facility level. Their advanced power and thermal management systems help data center operators reduce PUE (power usage effectiveness) and extend the life of infrastructure with AI-driven energy optimization.

- Schneider Electric (EPA: SU) is another global leader offering sustainable design and energy automation technologies. Their EcoStruxure platform helps operators model and implement sustainable building practices, from modular construction techniques to renewable energy integration. They work closely with hyperscale and enterprise clients to incorporate low-carbon materials and LEED-compliant practices into greenfield developments.

Operational Excellence: The Foundation for Competitive Advantage

In an industry driven by uptime, security, and scalability, operational excellence isn’t a buzzword—it’s survival. The ability to consistently deliver reliable, efficient, and secure services is what distinguishes long-term winners from commoditized players. The best operators are combining engineering rigor with customer responsiveness to build defensible, high-margin platforms.

- Equinix (EQIX) again stands out, consistently delivering 99.999%+ uptime across its platform. Their global interconnection hubs are engineered with N+1 and 2N redundancy standards, ensuring uninterrupted service even in extreme scenarios. Equinix’s reputation for uptime is a key factor in attracting financial services, government, and AI customers that simply cannot tolerate outages.

- CoreSite (owned by American Tower Corp – AMT) has built its brand around low-latency, high-efficiency operations in major metros like New York, Denver, and Silicon Valley. Known for strong PUE performance and high-density power configurations, CoreSite facilities are tailored for cloud and AI workloads that demand scalable, energy-conscious infrastructure.

- Super Micro Computer (SMCI) supports operational excellence from the hardware side. Their customizable, energy-optimized servers allow operators to run denser, more efficient racks—critical as AI pushes power requirements past 80 kW per rack. SMCI’s modular systems are also designed for easy maintenance and hot-swapping, minimizing downtime and labor.

- Cisco Systems (CSCO) and Arista Networks (ANET) are essential to maintaining strong security protocols and network resilience. Both companies provide the backbone switching, segmentation, firewalls, and telemetry required for secure, high-availability environments. Their platforms enable zero-trust architectures and real-time threat detection—now a baseline expectation among enterprise customers.

- Akamai Technologies (AKAM), though traditionally seen as a CDN provider, exemplifies responsive customer service and operational agility in the edge and cloud security space. Their ability to onboard clients quickly, monitor network health in real time, and respond to evolving security threats makes them an increasingly valuable partner in hybrid and edge-focused deployments.

Operational excellence isn’t just about ticking technical boxes—it’s about creating trust, resilience, and scalability in an industry that powers the digital economy. These companies have what it takes to succeed in today’s environment and are set to benefit as customer expectations continue to rise.

The most attractive investments combine these elements while maintaining flexibility to adapt to emerging technologies and changing customer requirements. Companies that can execute across these dimensions while maintaining financial discipline typically command premium valuations.

The Road Ahead

The data center sector stands at a transformative crossroads, where traditional infrastructure meets cutting-edge technology demands. This evolution creates both unprecedented opportunities and complex challenges that will reshape the industry over the next decade.

Several key trends will drive this transformation:

AI Infrastructure Demands will continue to accelerate, requiring data centers to support power densities exceeding 100 kW per rack. This shift demands fundamental redesigns of power distribution, cooling systems, and facility architecture. Successful operators must balance these high-density requirements with traditional workloads while maintaining operational efficiency.

Energy Innovation will become increasingly critical as power demands grow. The integration of small modular reactors (SMRs), advanced natural gas systems, and renewable energy will create new opportunities for operators who can effectively manage complex hybrid power solutions. Strategic locations near reliable power sources will command premium valuations.

Edge Computing Growth will drive demand for smaller, distributed facilities to support low-latency applications. This trend creates opportunities for operators who can efficiently manage networks of smaller facilities while maintaining the economies of scale needed for profitability.

Environmental Sustainability will move from aspiration to requirement. Successful operators must demonstrate clear paths to carbon neutrality, water conservation, and energy efficiency. This transition will require significant investment but will become essential for maintaining customer relationships and regulatory compliance.

The winners in this evolving landscape will be companies that can:

– Execute complex infrastructure projects while maintaining reliability

– Adapt quickly to changing technology requirements

– Manage environmental impacts effectively

– Maintain strong customer relationships

– Access capital markets efficiently to fund growth

– Navigate increasingly complex regulatory environments

For investors, the data center sector offers unique exposure to both technological innovation and infrastructure stability. While challenges exist, particularly around energy consumption and environmental impact, the fundamental growth drivers remain strong. As our digital economy continues to expand, data centers will become increasingly critical to global infrastructure.

The Bottom Line

The data center industry represents a unique investment opportunity at the intersection of real estate, technology, and infrastructure. While the sector faces challenges, particularly around energy consumption and environmental impact, the fundamental growth drivers remain strong.

As our digital economy continues to expand and evolve, the importance of data centers will only increase. Data centers offer an attractive combination of current income and long-term growth potential for investors who understand the sector’s complexities and choose their investments wisely.

Remember, as with any investment, thorough due diligence is essential. But for those willing to do their homework, the data center sector provides a compelling way to participate in the ongoing digital transformation of our economy.