Introduction

America’s national debt crisis has reached an alarming scale, with current figures surpassing $35 trillion. This staggering amount casts a long shadow over the nation’s economic future and underscores the urgent need to understand both the root causes and potential solutions.

Several historical challenges have contributed to this predicament:

- The economic volatility of the Roaring Twenties

- The Great Depression

- Two World Wars

- 1970’s Stagflation

- More recent events like the 2008 financial crisis and the COVID-19 pandemic

Each era has left its mark on America’s fiscal landscape. Understanding these factors is essential for addressing the core issues that perpetuate escalating debt levels.

Fiscal responsibility plays a crucial role in ensuring economic stability. Without it, the consequences extend beyond immediate financial strain; they jeopardize long-term growth and prosperity. Future generations will bear the burden unless meaningful reforms are implemented.

Exploring the national debt crisis—root causes and potential solutions—becomes essential for any comprehensive discussion on America’s economy. Policymakers and citizens alike must prioritize sustainable fiscal policies to navigate this complex issue effectively. The path to fiscal stability may be painful, but it is necessary for securing America’s economic future.

NOTE: click on any of the words shown in green for links to additional information or source material for the subject.

Understanding America’s National Debt

The current national debt of the United States stands at a staggering $35 trillion +. This immense figure reflects decades of fiscal policies, economic events, and demographic shifts. To grasp the magnitude of this debt, it is essential to explore the historical context that has contributed to its accumulation.

Historical Challenges Leading to the Current Crisis

Several key events in American history have played a significant role in shaping the current national debt:

- Roaring Twenties and the Great Depression: The economic boom following World War I led to increased consumer spending and speculative investments. However, this period of prosperity was followed by the Great Depression, which saw the federal government implementing extensive public works programs and social safety nets, significantly increasing national expenditures.

- World War II: The war effort required massive government borrowing and spending, leading to a surge in national debt. The post-war era saw continued government intervention in the economy through various programs aimed at maintaining employment and stimulating growth.

- 1970s Stagflation: This period was characterized by the simultaneous occurrence of high inflation and economic stagnation. The government’s attempts to combat these issues through monetary and fiscal policies led to increased borrowing and spending, contributing to the growth of national debt.

- 2008 Financial Crisis: The collapse of major financial institutions necessitated unprecedented government bailouts and stimulus packages, further inflating the national debt.

- COVID-19 Pandemic: Recent history has seen another significant spike in national debt due to emergency relief measures aimed at mitigating the economic fallout from the pandemic.

Economic Implications on Future Generations

The economic implications of such a high national debt are profound:

- Interest Payments: A substantial portion of the federal budget is allocated to interest payments on existing debt, reducing funds available for critical investments in infrastructure, education, and healthcare.

- Crowding Out Effect: High levels of government borrowing can lead to higher interest rates for private borrowers, potentially stifling business investment and household consumption.

- Intergenerational Equity: Future generations will inherit not only the benefits of current public spending but also its financial burdens. This raises ethical concerns about fiscal responsibility and sustainability.

Understanding America’s national debt requires an appreciation of both its historical roots and its future ramifications. As we delve deeper into this crisis, it becomes clear that addressing it will require comprehensive strategies and unwavering fiscal responsibility and discipline.

Root Causes of the National Debt Crisis

Government Spending Outpacing Revenue Growth

One of the main reasons behind America’s national debt crisis is the gap between government spending and revenue growth. In recent decades, federal spending has increased at a rate much higher than the rate at which money is collected. This imbalance has led to ongoing budget deficits, which in turn have caused the national debt to grow.

Key Factors:

- Defense Spending: The U.S. spends a large part of its budget on defense. Ongoing military operations and the development of advanced technologies have driven costs up, especially during times of war. However, on a relative basis, it has declined steadily and significantly as a percentage of GDP.

- Entitlement Programs: Social Security, Medicare, and Medicaid are significant financial commitments. As demographics shift and the population gets older, these expenses continue to rise without corresponding increases in revenue. Contrary to Defense Spending, Entitlement Program Spending has increase in both relative and absolute terms.

Consequences of Tax Policy Changes Over Decades

Changes in tax policy over the years have had a significant impact on the national debt. Adjustments in tax rates and structures directly affect how much money is collected.

Historical Context:

- Kennedy Tax Cuts: In the early 1960s, President Kennedy proposed significant tax cuts, which were implemented in 1964 after his death. These cuts lowered the top marginal tax rate from 91% to 70% and reduced the corporate tax rate. The intention was to stimulate economic growth by increasing disposable income and encouraging investment. Following the tax cuts, the U.S. economy experienced a surge in growth, with GDP increasing and federal revenues also rising as a result of broader economic expansion.

- Reagan Era Tax Cuts: While the initial Economic Recovery Tax Act (ERTA) of 1981 did reduce top marginal tax rates, federal revenues increased over the 1980s. Total federal revenues doubled from $517 billion in 1980 to over $1 trillion in 1990, representing a 28% inflation-adjusted increase. This was largely due to economic growth and broader tax base expansions that followed the cuts. In fact, revenues from individual income taxes alone increased by 25% in inflation-adjusted terms during this period

- Bush Tax Cuts: In the early 2000s, income and capital gains taxes were further reduced, which stimulated the economy in the short term but additional cuts were later implemented to increase the economic impact to increase tax revenues received by the treasury. However, this revenue increase was not enough to keep up with the spending on the post-911 rebuilding and war efforts.

- Trump Tax Cuts: The Tax Cuts and Jobs Act (TCJA) of 2017 lowered corporate tax rates from 35% to 21% and reduced individual income tax rates, leading to increased economic activity, job creation, and higher consumer spending. This spurred a boost in tax revenues due to higher economic growth.

Impact of Taxpayer Behavior on Revenue Collection

How taxpayers behave is crucial for how efficiently money is collected through taxes. Various factors influence how taxpayers respond to taxation policies, which in turn affects the overall health of government finances.

Behavioral Insights:

- Tax Evasion and Avoidance: Complex tax codes with many loopholes encourage people to evade or avoid paying taxes. This leads to a significant loss of revenue.

- Economic Climate: During times when the economy is doing poorly, such as during the Covid pandemic, taxpayers may earn less or delay making payments, resulting in less money coming in right away.

- Compliance Rates: Simple tax systems tend to have higher compliance rates, meaning more people are following the rules and paying their taxes.

Understanding these root causes is essential for coming up with strategies that tackle the main issues driving America’s national debt crisis. Effective solutions must consider both spending patterns and ways to collect revenue in order to achieve long-term fiscal responsibility and stability.

Demographic Influences on Economics

Demographic Shifts and Economic Impact

The changing demographics of the United States significantly influence economic dynamics, particularly healthcare demand. An aging population increases the burden on Medicare and Social Security, as more individuals require medical care and pension benefits. This shift not only escalates the cost of these entitlement programs but also exerts pressure on federal budgets, contributing to concerns about the National Debt Crisis.

Increased longevity and lower birth rates result in a higher dependency ratio, where fewer working-age individuals support a growing number of retirees. This demographic shift necessitates adjustments in fiscal policies to maintain economic stability and ensure Fiscal Responsibility.

Generational Impacts on Fiscal Policies

Different generations, from Millennials to Generation Z, have diverse economic behaviors and expectations that affect fiscal policies.

- Millennials: As they enter their prime earning years, Millennials demand affordable housing, education, and healthcare. Their financial priorities often include tackling student loan debt and saving for retirement, all while navigating the economic aftermath of Covid.

- Generation Z: Emerging into the workforce, Generation Z values economic security and environmental sustainability. Their preferences may drive policy changes towards more sustainable practices and better social safety nets, especially in response to social unrest triggered by systemic inequalities.

These generational influences require policymakers to adapt tax structures and entitlement programs to meet evolving needs while ensuring long-term fiscal health.

Workforce Participation

Labor force participation rates also play a crucial role in shaping the economy. Increasing workforce participation among underrepresented groups—such as women, minorities, and older adults—can boost economic productivity and expand the tax base.

- Women: Policies that support childcare and parental leave can enhance female workforce participation.

- Minorities: Addressing educational disparities and employment discrimination can help minority groups integrate more effectively into the labor market.

- Older Adults: Encouraging flexible working conditions and retraining programs can keep older adults engaged in productive work longer.

Entitlement Program Adjustments

If no changes are made, both Social Security and Medicare face significant financial challenges. According to the 2024 Trustees Reports:

- Social Security: The Old-Age and Survivors Insurance (OASI) Trust Fund is projected to be depleted by 2033. At that point, the system will only be able to pay about 79% of scheduled benefits from ongoing payroll tax revenues unless adjustments are made. If combined with the Disability Insurance (DI) Trust Fund, the combined OASDI fund would be able to pay full benefits until 2035, after which only 83% of benefits could be covered [U.S. Department of the TreasurySocial Security].

- Medicare: The Hospital Insurance (HI) Trust Fund, which funds Medicare Part A, is projected to run out by 2036. After that, the program would be able to cover only 89% of its scheduled benefits. However, other parts of Medicare, such as Medicare Part B (Supplementary Medical Insurance), are funded through automatic adjustments in premiums and Treasury contributions, so they are not at immediate risk [U.S. Department of the TreasuryCenter for Retirement Research].

Without policy changes, beneficiaries of these programs could face benefit cuts starting in the mid-2030s, affecting millions of retirees and individuals relying on healthcare coverage. Early actions, such as tax adjustments or benefit changes, could help spread out the impact and ensure long-term solvency for both Social Security and Medicare [Social Security]

Adapting entitlement programs to reflect current demographic realities is essential. Traditional policy changes that have been debated openly include:

- Raising Eligibility Ages: Increasing the eligibility age for Social Security and Medicare is often proposed to reflect increased life expectancy. This would reduce the number of years people receive benefits and cut program costs. For example, raising the Medicare eligibility age from 65 to 67 could reduce Medicare spending by about 5% [NBER] [Social Security]. Similarly, raising the Social Security full retirement age to 70 could reduce program spending by about 13% [NBER].

- Means-Testing Benefits: Implementing means-testing for Social Security and Medicare would ensure that higher-income individuals receive reduced benefits or pay more into the system. This would shift more resources to those in greater need and help control costs. Studies have shown that means-testing Medicare could reduce benefits for the wealthiest 5-10% of seniors[NBER] [Social Security].

- Encouraging Private Savings: Incentivizing private retirement savings through tax benefits could reduce reliance on public entitlement programs. These measures would shift some financial responsibility to individuals, allowing the government to focus resources on those most in need. Proposals like expanding tax-favored savings accounts could be part of this strategy [Social Security] [Center for Retirement Research.]

However, we are likely at the point where the traditional policy changes would need to be combined with bolder action.

Back in the early 2000’s, President Bush offered the suggestion that a portion of the social security trust fund (yes, I know its a figment of the imagination as the government uses the social security tax revenues it receives to offset its budget deficit in other spending and simply gives the trust fund IOU’s for those revenues, but this is a thought exercise so roll with it) be invested in the stock market. Where would we be now if that had been implemented into policy compared to our current dire circumstance.

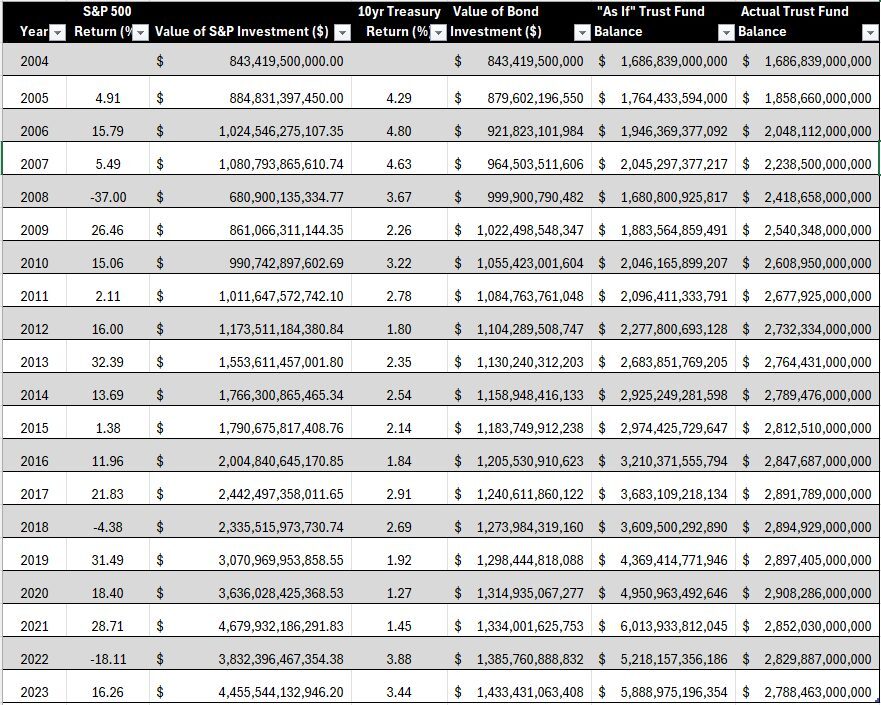

If a policy to invest 50% of the Social Security Trust Fund in the stock market had been implemented in 2005, specifically the S&P 500, it would have fundamentally altered the risk and return profile of the trust fund. Let’s look at the impact of this decision from 2005 until today, in terms of the solvency of the Social Security program and the impact on future generations’ ability to receive benefits.

Historical Performance of the S&P 500 (2005-2024)

To understand the effects of investing in the S&P 500, it’s helpful to understand the market’s performance during this time frame – because there have honestly been some scary moments where the decision would have looked stupid:

- 2005-2007: Moderate positive returns.

- 2008 Financial Crisis: A significant downturn, with the S&P 500 losing about 37% in 2008 alone.

- 2009-2019: Strong recovery followed by a long bull market, with average annual returns around 10-12% (nominal).

- 2020-2022: Volatility due to COVID-19 pandemic, resulting in sharp losses initially, followed by a fast recovery.

- 2023-2024: The market experienced volatility, but overall, there was continued growth in the market.

Since 2005, the S&P 500 has experienced an average annual return of approximately 8-10%, even factoring in significant market downturns such as the 2008 financial crisis and the COVID-19-related volatility. In contrast, the Social Security Trust Fund, which primarily invests in government bonds, yields relatively low returns (around 2-3%).

Impact on the Trust Fund Solvency

- Higher Returns, Higher Volatility: Had the trust fund invested 50% in the S&P 500, it would have experienced significantly higher returns over the long run compared to government bonds. The equity portion would have grown substantially during the long bull market following the 2008 crash. For instance, during periods like 2009-2021, the gains from equity investments would have substantially outperformed traditional government bond returns.Assuming average annualized returns of 8-10% for the equity portion, the Social Security Trust Fund would have accumulated much larger assets over time compared to only investing in government bonds. This could have extended the solvency of the program beyond current projections, especially given that the current trust fund is expected to face depletion around 2034-2035 based on recent reports.

- Exposure to Downturns: However, the increased market exposure would also mean exposure to significant downturns like the 2008 financial crisis. During that period, the trust fund would have experienced a drastic drop in value, which could have led to panic or political pressure to sell assets at a loss. The market did recover, and long-term investors were rewarded, but the interim volatility could have raised concerns about the ability to pay benefits during downturns.

- Effect on Solvency: With 50% invested in equities, the trust fund’s solvency would likely be more favorable today, assuming no panic-selling during the 2008 crisis or subsequent downturns. The trust fund would have benefited from the robust post-2008 and post-2020 recoveries, potentially pushing back the depletion date by several years and enhancing its ability to cover future benefits.

Impact on Future Generations’ Benefits

- Greater Potential Benefits or Reduced Taxes: The increased returns could have provided the opportunity for either higher future benefits for recipients, a reduced need to increase payroll taxes on future generations, and a likelihood that future generations would actually benefit in the same way today.

- Intergenerational Equity: The investment could have improved intergenerational equity by potentially reducing the burden on younger workers who are currently projected to face either higher taxes or lower (or no) benefits to maintain Social Security’s solvency. If the trust fund had grown more robustly, the required adjustments to keep the program solvent would be less drastic and the benefits more sustainable.

- Increased Risk Exposure: One of the biggest political arguments against investing in the stock market was the risk of market downturns and the possibility that pensioners would lose benefits in the case of a crash. Investing in equities would have introduced a significant risk element—if withdrawals coincided with a major downturn (e.g., 2008 or early 2020), the trust fund could have faced short-term liquidity issues, impacting its ability to pay current beneficiaries without selling equities at a loss. However, the long-term nature of Social Security means that it could have theoretically weathered such downturns, provided that there were adequate risk management practices and buffer funds in place to manage cash flow during market corrections. With only 50% invested in the stock market, there are adequate reserves in the other 50% so that payments would not be interrupted.

Comparison to Today’s Scenario

- Current Scenario: Today, the Social Security Trust Fund primarily holds government bonds (i.e., the IOUs), which are safe but low-yield investments. Given demographic pressures and rising benefit obligations, the trust fund is projected to be depleted around 2034-2035. After depletion, payroll tax revenues would be sufficient to cover only about 77-80% of scheduled benefits then reduce from there as the population of retirees grows faster than the population of working adults paying into the system.

- Hypothetical Scenario with S&P 500 Investment: If 50% of the trust fund had been invested in the S&P 500, the overall balance of the fund would likely be significantly larger today (more than double per the table below), assuming a long-term investment approach without panic-selling during downturns. This would imply a more extended solvency period, potentially moving the depletion date decades into the future, and increasing confidence in the program’s ability to meet future obligations.

- Below is a comparison of the growth of the Social Security Trust Fund “As If” the policy had been implemented in 2005 compared to the “Actual” today – note that we ended 2004 with $1,686,839,000,000 as shown in the table at this link: https://www.ssa.gov/OACT/STATS/table4a3.html

Considerations and Challenges

- Political and Public Perception: The Social Security program is politically sensitive, and exposing it to the stock market would have faced significant criticism, especially during downturns like 2008 or 2020. Public perception plays a large role in the viability of such a policy, and it’s possible that during tough times, political pressures would have led to changes in investment strategy, potentially locking in losses.

- Risk Mitigation: To manage the risks associated with market volatility, the trust fund could have adopted a phased investment approach or implemented risk management strategies, such as dollar-cost averaging so that the impact of the 2008-009 bear market would not have been as dramatic.

- Historical Context: The 2008 crisis would have been a major stress test. If the trust fund had remained committed to equity investments through the downturn, the subsequent gains would have been significant, but the interim political pressure and concerns about paying benefits could have created a challenging environment for policymakers.

If managed properly, with a long-term focus and adequate risk mitigation, such an investment could have improved the fund’s health significantly, enhancing the ability of future generations to receive full benefits without as much fiscal pressure. However, the key challenge would have been navigating the political and public reactions during periods of volatility to maintain the course and capture the long-term growth potential of the stock market.

The question is: should this policy change be considered now given that it would lower the impact of the funding shortfall on future budget deficits and the resulting growth in the national debt.

The Role of Monetary Policy in the National Debt Crisis

Monetary policy plays a significant role in influencing national debt levels. Central banks, particularly the Federal Reserve, set interest rates that directly impact borrowing costs and spending behaviors across the economy. This is especially crucial during periods of economic turmoil such as depressions or times of war, where increased government spending may be necessary to maintain stability.

Examination of Monetary Policy’s Role in Exacerbating National Debt Issues

The Federal Reserve’s monetary policy can either mitigate or exacerbate national debt issues. When the Fed adopts an expansionary monetary policy—characterized by lower interest rates and increased money supply—the immediate effect is stimulation of economic activity. However, this often leads to higher levels of government borrowing as cheap credit becomes more accessible, further complicating the national debt crisis.

Key Points:

- Expansionary policies increase liquidity but can lead to excessive borrowing.

- Higher government debt results from increased public spending facilitated by low-interest loans, particularly in response to crises like Covid.

- Inflation risks arise when too much money chases too few goods, eroding purchasing power and potentially fueling social unrest.

Effects of Low Interest Rates on Borrowing and Spending Behaviors

Low interest rates encourage both public and private sectors to borrow more. While this can spur economic growth in the short term, it also increases long-term liabilities that must be carefully managed through fiscal responsibility.

Impact on Borrowing:

- Government Borrowing: Lower interest rates reduce the cost of servicing existing debt, enabling governments to issue more bonds without immediate fiscal strain. This is particularly relevant when considering the overall national debt levels, especially during periods of increased spending due to demographic shifts or crises like Covid.

- Private Sector Borrowing: Businesses and consumers are more likely to take out loans for investment and consumption as borrowing costs decline.

Impact on Spending:

- Increased borrowing translates to higher spending in areas such as infrastructure, social programs, and military expenditures.

- Consumer spending rises due to easier access to credit, driving demand but also potentially leading to asset bubbles and financial instability.

Risks Associated with Low Interest Rates:

- Debt Accumulation: Persistent low rates contribute to a cycle of rising debt levels as borrowing becomes entrenched in fiscal policies.

- Inflationary Pressures: Sustained low rates can lead to inflation if economic output fails to keep pace with increased demand.

- Asset Bubbles: Excessive liquidity often flows into financial markets, inflating asset prices beyond their intrinsic values.

Understanding these dynamics is crucial for devising strategies that balance economic growth with fiscal responsibility. The interplay between monetary policy and national debt underscores the need for prudent economic management. For instance, while the Fed’s approach has its benefits, it’s essential to remain aware of the potential costs associated with prolonged periods of low interest rates as highlighted by various studies including those published by the St. Louis Fed.

Potential Solutions to Address the National Debt Crisis

Implementing Pro-Growth Tax Policies

Historical Context on Tax Cuts

Economic history has shown that tax cuts can stimulate economic growth, particularly during periods of crisis such as the Great Depression, following major wars, as a counter to stagflation, and to counter economic malaise as shown in the sections above.

Recommendations for Lowering Rates While Ensuring Fiscal Responsibility

Balancing pro-growth tax policies with fiscal responsibility is crucial in addressing the national debt crisis. Recommendations include:

- Targeted Tax Reductions: Focus on lowering taxes that have a direct impact on economic growth, such as corporate taxes and capital gains taxes.

- Spending Cuts: Implement strict budget controls similar to those implemented during the Clinton balanced budget era and those outlined in the Budget Control Act of 2011. This act enforced discretionary spending caps and automatic sequesters.

- Revenue-Neutral Policies: Ensure any tax cuts are balanced by closing loopholes or increasing other forms of revenue like targeted tariffs used by both Trump and Biden presidencies to brign in additional revenues.

tax policies offer a path toward economic stimulation but must be implemented with caution to maintain fiscal balance.

Adjustments to Government Spending

Aligning entitlement programs with current economic realities is another crucial step. For example:

- Social Security Reform: Gradually raising the retirement age, adjusting benefits based on income levels, and modifying cost-of-living adjustments could help sustain Social Security.

- Healthcare Reform: Implementing measures to control healthcare costs while maintaining quality, such as negotiating drug prices and encouraging preventive care, can reduce the burden on Medicare.

The Budget Control Act of 2011 serves as a historical attempt to align government spending with sustainable revenue levels. Though not without criticism, it aimed to enforce budgetary discipline by setting caps on discretionary spending.

Simplifying the Tax Code

The complexity of the U.S. tax code has long been a subject of debate, with numerous attempts at reform over the decades. The Tax Reform Act of 1986 stands out as a significant effort to streamline the system. This legislation aimed to eliminate loopholes and broaden the tax base, ultimately reducing rates and simplifying compliance.

Eliminating Loopholes for a Fairer System

Tax loopholes create inequities by allowing certain individuals and corporations to significantly reduce their tax liabilities. Closing these gaps is essential for fostering a fairer system. The Budget Control Act of 2011 attempted to address some aspects of fiscal responsibility, but complexities remain.

Reviewing Recent Increases in Government Spending

Government spending has spiraled out of control since Covid. The temporary assistance programs raised the level of overall spending, but new spending initiatives have been adopted to make the increase indollar levels of spending permanent. An overall review of the new spending should be undertaken to ensure that it is effective.

Current government revenues would cover 2019 spending levels – lets cut waste and duplication to return to 2019 spending levels much like President Clinton and Speaker Gingrich did to balance the budget then. All it takes is some bipartisan action and its is achievable.

Mark